As I earn my money with microstock, I follow some forums to keep up to date with the latest news. While reading through the new posts, the terms Revenue Per Image (RPI) and Revenue Per Download (RPD) are used quite often to indicate important microstock statistics. However, those simple statistics are often misinterpreted or not rightly used. Leading to a devaluation of those simple terms while they can be quite useful.

How to calculate RPI / RPD / PS

It is quite easy to calculate those stats. (Or just download our app) For RPI you divide the total revenue by the total amount of images in your portfolio. If you earned $100,- last month and you have 1000 images, your revenue per image would be $100/1000= $0,1. Which will say you earned on average 0.1 cents per image in your portfolio. For RPD you simply divide your total revenue by the amounts of downloads. If you earned those $100,- by selling 50 images, your RPD would be 100/50 = $2,-. That is an average of $2,- per download.

When should you calculate your stats? I’m not looking at it at a daily base but rather once every 3 months or even half-yearly. Zooming in to much will only show large fluctuations as outliers will become more common especially if you are not selling much. I would stick to the following time spans**:

** You should not look at a smaller time-period than that you add new assets. If you add assets on a monthly basis, do not look at time periods smaller than monthly as you will have a large fluctuation every time you add new images!

Now we know how to calculate the microstock statistics RPI, RPD and PS. Moreover we know when to calculate it. But what can we do with the stats? I use those stats mainly to see whether I’m doing fine with the quality/quantity of my portfolio. Also, I can easily differentiate the value of different asset types (Editorial/commercial & video/photo). This helps me by choosing the right asset type and gives me a good indication if I’m still progressing or should try to improve more on quality/quantity to enhance my portfolio earnings. A small side-note: I always keep in mind that those stats are indications and not the full truth as there are more factors to keep into account which can change the indications.

Let's demonstrate this:

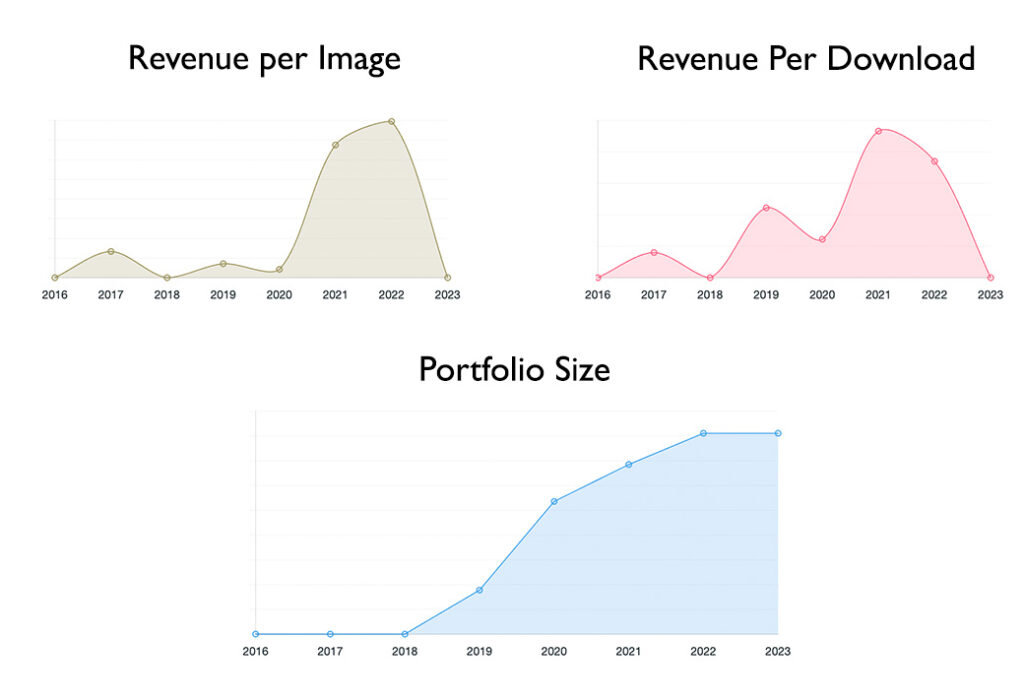

I will show you some examples from my portfolio. But first of all, let me stress that RPI and RPD should not be looked at separate. Moreover, to be able to get useful information from your RPI and RPD you should also know your Portfolio Size (PS) as well. Looking at one without taking the others in account might lead to wrong conclusions. Whereas the combination of the three stats could give you useful indications about your portfolio earnings. In the image below you can find my RPI, RPD & PS.

Let’s look at my overall portfolio performance first. If we look at my RPI you can see that it went up in 2017, then my RPI went straight down after which I went up slightly, but I had some trouble getting it higher. Finally in 2021 the RPI went up and rose steadily. What does this mean? It could mean:

We really need the other stats (RPD and PS) to figure out a what is happening with my RPI. My PS in 2017 was almost zero. So, the initial bump in RPI is most likely an outlier (In fact it comes from just one sale that year). My PS has been increasing with ±1000 assets a year since 2019 and I can tell you I have never deleted an asset from my portfolio. So, we skip point 3 And 4. Moreover, we know now that I’ve been earning more and more with my portfolio as I’ve been adding assets and the average earnings per asset in my portfolio have been gone up. That’s a double gain and a first indication that what I am doing is working!

Quantity versus Quality check

Now, we would like to see whether the assets are simply picking up in amount of sales or whether I am adding more valuable assets. Let’s have a look at the RPD: as the RPD is increasing we know that the average price being paid for my assets is increasing, which probably means that my latest assets are worth more than my earliest assets. That’s a second indication that my assets are doing better and I am improving on my photography skills or metadata skills! You can see that the RPD and RPI in 2021 are very similar, which will say that the increase in RPI is mainly due the increase in RPD and not due to the increase in downloads per asset.

In 2022 the RPD decreased while the RPI increased. That is a clear indication that my assets are selling more than before but many of those downloads are for a lower value. Sadly, we cannot tell for sure whether those downloads are from the newer assets or the older assets. Hence, there could be two different situations:

Another statistic: ‘unique images sold’ could give you an indication whether you are selling more different assets or whether the same assets are selling more. More about this in a future blog!

Back to the RPI: there is namely another indication that your RPI is increasing due to a higher amount of downloads per asset. This can be spotted when the RPD is flatter than the RPI as you can see in the figure below (look at the year 2022).

Comparing agencies

Another use of the RPD is to look whether an agency is still worthy of your attention. Paycuts are common and the microstock industry is getting harder and harder. Simply check the RPD to see what the average royalty is that you get for your assets, if you think it’s too low (especially when the RPI is also very low) you can choose not to upload to that agency anymore or even to delete your entire portfolio at that agency. Should you look at RPD only here? No, I would keep PS and RPI in mind next to the RPD when looking at those microstock statistics!

So far, we’ve looked at increasing RPI (positive). But what if your RPI has been decreasing? Let’s quickly try to reason the other way around

What about comparing stats with others?

Okay, we have calculated our stats and know more about our portfolio. That’s all well but when someone posts their stats online I always go quickly to mine and when I’m doing better I quickly say to my screen (directed at that person) that I’m better! If not, I just assume that person brushed up his numbers a little in Excel or Photoshop and I’m close to the same. Jokes aside;

Do not believe every single stat you see! Quick calculations, averaging numbers, estimate of PS etc. makes the actual number often different. Furthermore you should not compare pears with apples: if you sell only videos, do not look at the RPD of another persons images.. Also, look at PS when comparing stats. A portfolio with 10 assets that have a high RPD counts for something but a portfolio with 1000 assets is still more likely to earn much more even though the RPD is not as high.

Lastly, as said before: those are indications. For one, the level reset at Shutterstock will make sure your RPD is lower at the start of the year. You should keep this (and other factors) in mind when looking at the indications! Nevertheless, those indications (RPI, RPD and PS) used in microstock statistics can be very useful to set a goal for the next period.

Leave a Reply